BIZZ WIZZ WAGES PAYROLL

Input Employees

Bizz Wizz : Setup , Main Menu , Ledger , Phone Book , Invoice Book , Stock Book , Order Book , Creditors , Point of Sale , Business Name , Diary , Document Manager , Wages Payroll , Unlock , Backup

See Also : Wages Menu , Tax Totals , Setups , Employee List , Pay Run , Input Employees & Adjustments , List Pay Runs , Super Help

NOTE: By moving the mouse over the buttons, the help box at the bottom of that screen will give you a brief description of the function of that button.

Disclaimer

Warning - It is the responsibility of the employer to check all monetary results of this software.

Bizz Wizz Software has endeavoured to make this software as accurate as possible. As payroll has many variations that may not have all been for seen at the time of the program's creation, Bizz Wizz Software does not take any responsibility or liability in any way for results of monies paid using this software. All results of financial or other need to checked by the program user to ensure the integrity of all output from this software. Taxation and work place agreement changes etc. may invalidate the output of this software and it is the responsibility of the program user to be aware of this.

Tax File Number Enter the employees Tax File Number. This is to identify an individual within the ATO. If a TFN exemption is

being sought, valid TFNs to use are:

BLANK - Only if an ABN is used instead

000000000 - Where the payee has not completed a TFN declaration, and failed to

provide a TFN within 28 days.

111111111 - Where the payee has not provided a TFN but they indicate on the TFN

declaration that they have applied or enquired about a TFN with the ATO. within 28

days,

after 28 days and no TFN use 000000000

333333333 - Where the payee is under the age of eighteen and earns $350 or less

weekly, earns $700 or less fortnightly or earns $1517 or less monthly.

444444444 - Where the payee is a recipient of a social security or service

pension or benefit (other than Newstart, sickness allowance, special benefits or

partner allowance) an exemption from quoting a TFN may be claimed.

For employment termination payments, in the event the payment is due to the

death of an employee, show either the TFN of the trustee for the deceased estate

or the TFN of the dependant or non dependant of the deceased employee, whichever

is applicable.

NOTE ALL FIELDS MUST BE FILLED IN

Birth Date Type in employees birth date manually or highlight the date/month/year and use the drop down arrow to bring up the calendar

First Name Enter the employees first name

Middle Name Enter the middle name of the employee

Next of Kin Name Enter the contact name of next of kin

M=male F=female Type in either M or F

Employed Date Type in employees date of employment manually or highlight the date/month/year and use the drop down arrow to bring up the calendar. This date must be entered correctly as it directly affects the long service leave entitlements.

Street Address Enter the street name and number of employee

City / Suburb Enter the city /suburb of employee

State Enter the state of the employee ( NSW, WA, SA, VIC) ect.

Post Code Enter the post code of the employee

Kin / Spouse Ph/Mobile Enter the next of kin or spouses phone number or mobile number

Phone Number Enter employees phone number

Mobile number Enter employees mobile number

Email Address Enter employees email address

Job Title Enter the job title of the employee

Employed Type Use the drop down arrow to select the type of employment

Wage Payment Settings Button See Below sets up the wage payments.

RDO hours. Per Week Enter these hours if employees have RDO's

Hours Due RDO This box is normally left empty unless they have hours due to them. If the box is left blank the hours will accrue automatically after each pay run

RDO Drop down box Click on the drop down arrow to select if there are no rdo's , or if they are, whether they are funded or unpaid

Holidays Per Year If the employee is full time there are 20 working day holidays per year. If the employee is casual or permanent part time these hours need to be changed accordingly

Days Due ( holiday ) Leave this box blank as each time a pay run is done the hours due will be automatically calculated and accrued

Leave Loading Current leave loading is 17.5 %

Sick Days Per Year If the employee is full time there are10 sick days per year. If the employee is casual or permanent part time these hours need to be changed accordingly

Days Due (sick days ) Leave this box blank as each time a pay run is done the hours due will be automatically calculated and accrued

L S Leave Per Year Long service leave is calculated @

4.3335 working days per year

The help box at the bottom window will calculate the leave form the start date!!

for you.

Days Due (Long service leave) Leave this box blank as each time a

pay run is done the hours due will be automatically calculated and accrued

NOTE: The help box at the bottom window will calculate the leave form the start

date!! for you.

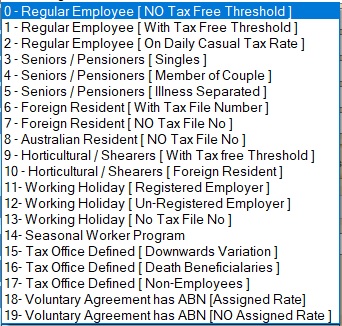

Enployee Tax Type select Best fit for this employee

Tick if Not Australian or Non Resident Auto with above selection.

Use Tax Free Threshold Auto with above selection.

Click on the Medicare Levy / Exemption button if you need to set Medicare settings

Tax Scale Table Enter Tax Scale Table manually or click on Auto Set

Tax Free tick box and no tax withheld option. If ticked no tax is withheld , sometime use if income is below taxable amount.

Wage Payment Presets

Reference Detail This reference detail may appear on the employees bank statement ( i.e. Wages or your company name )

Pay From Use the drop down arrow to select the bank name and number from which the employees wage is being paid

Ledger Category No Type in the category number or use the drop down arrow box to view and select the category name and number. If the category is not listed the category must be entered through set ups in the ledger

Link Creditor Account For Wage Clicking on this box will create an account for the employee in the Suppliers list

Super Contribution Payments ( This box must be ticked only if compulsory super contributions are applicable)

Reference Detail Enter the name and policy number of the employees superannuation fund

Pay From Use the drop down arrow to select the bank name and number from which the employees superannuation is being paid

Ledger Category No Type in the category number or use the drop down arrow box to view and select the category name and number. If the category is not listed the category must be entered through set ups in the ledger

Link Creditor Account for Super Con Clicking on this box will create an account for the employee in the Suppliers list

Add Picture Button Clicking on this button will bring up a Windows browse dialogue box so you can select the picture file you require. For more help click on the question mark at the top of the screen of the dialogue box

Documents Button Clicking on this button will display the document manager

OK & Email button Clicking on this button will display the Bizz Wizz emailing screen

Print button When this button is clicked it will bring up a PRINT MENU screen. Select one of the options to Print, View, Export or email as a PDF

Medicare Levy To claim the medicare levy variation the employee must supply the employer the required form attained from the Australian Taxation Office

OK Save button Clicking on this button will save the employee record and return to the employee list

STD Pay Period Use the drop down arrow to select the pay term.

Last Paid Run Date This box shows the last pay run date DONE or if there has been no pay run it will show date of employment.

Paid Up To Date Unless the employee has been forward paid !! This box should show the same date as the Last Paid Run date or the date of employment.

Award Hours Per Day The figure 7.6 in this box is for a

38 hour week. Include RDO's per day if applicable. (0.4) = 8hr

Note : The Award Hours Per Day is the award and will not change

if the employee only works 20hrs a week normally of the 38hr award.

Must be set right or the holiday accrual will not work out right.

Std. wage Hours 1 Enter the employees normal hours per pay at

S.H.Rate1.

These include RDO's if applicable.

Note 1 : Set to the hours normally worked 0 to 38 or greater.

Note 2 : Hours worked can be change at time of paying when tagging to

pay.

Standard 2 Wage hrs 2 and

Standard 3 Wage hrs 3 can be renamed if needed.

These rates are when you have more than one rate Eg: hours 6am to 6pm are at one

rate and hours from 6pm to 9pm are at another.

The second rates are not overtime but are just not the same rate.

You can set if these rates are included in the in Holiday and Super

calculations.

Overtime Per Wage 1 Enter normal overtime hours if any @

this rate. Overtime Hr Rate1 Enter the rate of pay per hour.

Note- only put in hours if they are normally accrued each pay

otherwise Super contributions will be included for these hours )

Note 2- Hours can be set when wage pay is being done and super will

NOT apply.

Overtime Per Wage 2 Enter normal overtime hours if any @

this rate. Overtime Hr Rate2 Enter the rate of pay per hour.

Note- only put in hours if they are normally accrued each pay otherwise

Super

contributions will be included for these hours ) )

Note 2- Hours can be set when wage pay is being done and super will

NOT apply.

Tick if all overtime is included in super con. Tick this box if all overtime is included in super con. calc. not just the normal overtime

Wage Total The amount in this box is

automatically calculated from hours and rate previously entered

x52 Annual , x26, x12, x13 This figure is automatically calculated to

show annual wage

FB Annual Value Enter the value of fringe benefits received by employee in the FBT year (April 1st to March 31st)

Vehicle Allowance per kilometre or Other type rate This field is use to calc a fuel rebates ect. enter dollar amount per kilometre. Set up in Adjustments an allowance to calc by this rate.

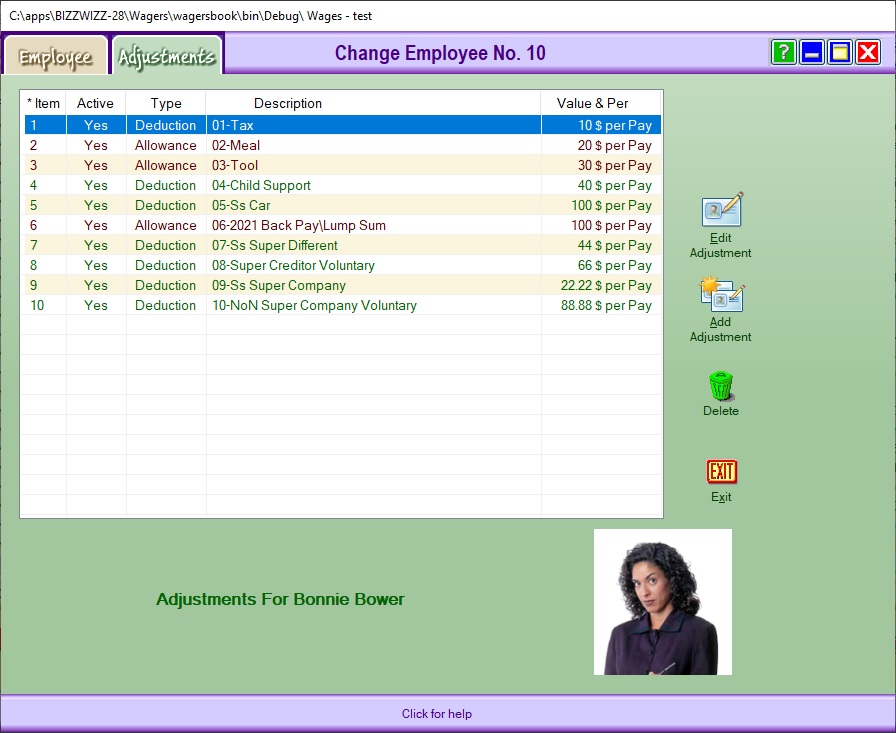

Adjustments Tab

Add /Edit Adjustments button Clicking on this button will bring up the screen below as does clicking the Adjustments Tab

The above screen shows you a list of all deductions and allowances for the employee.

The buttons on the right allow you to add, edit and delete these adjustments

The following screens differ if they are allowances or deductions

Add Adjustment button Clicking on this button brings up the adjustment screen

Deactivate Adjustment Tick Box When this box is ticked it will grey out all the boxes so they can not be used

Type of Adjustment Select whether the adjustment is a deduction or an allowance

The screen below has been set to allowance

Stop paying after (date) tick box This box is greyed out when the adjustment is an allowance

Type in Description Enter the type or description of the allowance for the employee

Calculate Amount - Do Before Tax Is Calculated This box is automatically ticked when the adjustment is an allowance

Calculate Amount by Use the drop down arrow to select the option - amount per pay, percent of normal pay, etc

Amount $ or % or Hrs box Type in amount number

Tick the next box if the amount has to be checked each pay or leave blank if it is always a set amount

Pay From Bank Click on the drop down arrow to select the bank name and number from which the allowance is to be paid. If the allowance is part of the wage, select 0. This will grey out the Ledger Category No box. If the allowance is paid separately from the normal wage, select the bank number.

Ledger Category If you have selected option 0 in the PAY FROM BANK box this will be greyed out. If you have selected another bank click on the list categories box to select the category number the allowance is paid to.

Special Allowances Use the drop down arrow to select the type of Allowance, Bonus or Commission

Amount of Tax box Depending on the type of allowance selected in the above box, type in the amount of tax. If it is a standard allowance this box will be greyed out.

If always in wage When this box is ticked it will add this amount into the total before calculating super con.

OK Save box Clicking this button will save the adjustments and take you back to the main adjustments screen

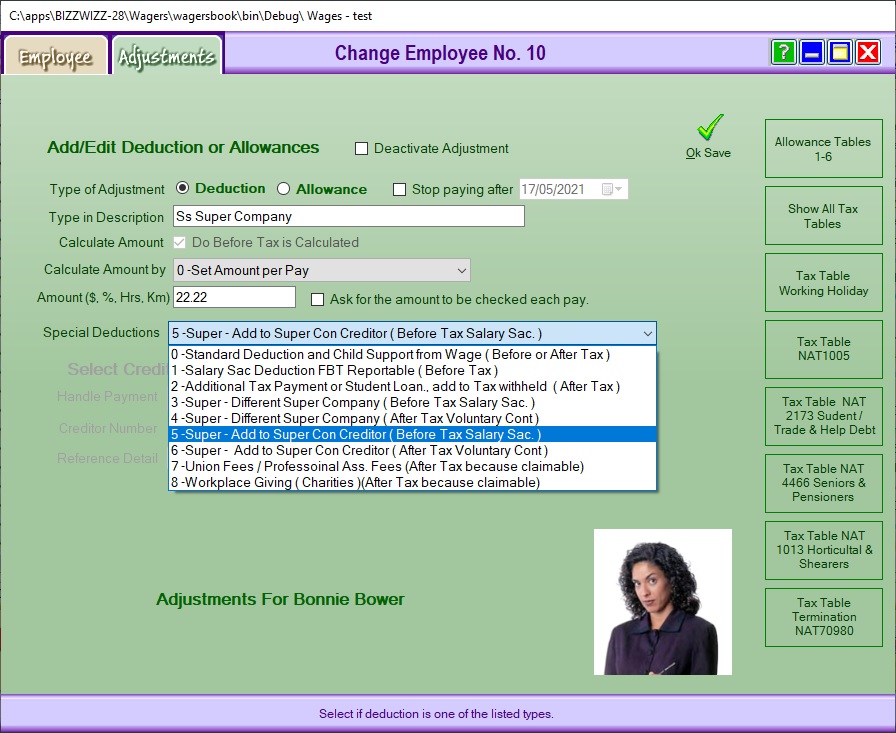

Deactivate Adjustment Tick Box When this box is ticked it will grey out all the boxes so they can not be used

The screen below has been set to deduction

Deactivate Adjustment Tick Box When this box is ticked it will grey out all the boxes so they can not be used

Type of Adjustment Select the adjustment to deduction

Type in Description Enter the type or description of the deduction for the employee

Stop paying after (date) tick box Enter the date in this box if the deduction is to stop at a given time

Calculate Amount - Do Before Tax Is Calculated This box will automatically tick or be left un ticked when the deduction is selected in Special Deductions box

Calculate Amount by Use the drop down arrow to select the option - amount per pay, percent of normal pay, etc

Amount $ or % or Hrs box Type in amount number

Tick the next box if the amount has to be checked each pay or leave blank if it is always a set amount

Special Deductions Use the drop down arrow to select the deduction

OK Save box Clicking this button will save the adjustments and take you back to the main adjustments screen

Deactivate Adjustment Tick Box When this box is ticked it will grey out all the boxes so they can not be used and the Adjustment will not be used.

Employment Termination Payments Types

R = ETP made because of one of the following: early retirement scheme, genuine redundancy, invalidity, or compensation for personal injury, unfair dismissal, harassment, or discrimination.

O = Other ETP not described by R (for example: golden handshake, gratuity, payment in lieu of notice, payment for unused sick leave, or payment for unused rostered days off).

S = ETP code R payment received in the current year and received another ETP (code R or code O), or a transitional termination payment, in an earlier income year for the same termination of employment.

P = ETP code O payment received in the current year and received another ETP (code R or code O), or a transitional termination payment, in an earlier income year for the same termination of employment.

D = Death benefit ETP paid to a dependant of the deceased.

B = Death benefit ETP paid to a non-dependant of the deceased and a termination payment was made to the non-dependant in a previous income year for the same termination.

N = Death benefit ETP paid to a non-dependant of the deceased.

T = Death benefit ETP paid to a trustee of the deceased estate.

See Also : Wages Menu , Tax Totals , Setups , Employee List , Pay Run , Input Employees & Adjustments , List Pay Runs