BIZZ WIZZ WAGES PAYROLL

List Pay Runs

Bizz Wizz : Setup , Main Menu , Ledger , Phone Book , Invoice Book , Stock Book , Order Book , Creditors , Point of Sale , Business Name , Diary , Document Manager , Wages Payroll , Unlock , Backup

See Also : Wages Menu , Tax Totals , Setups , Employee List , Pay Run , Input Employees & Adjustments , List Pay Runs , Super Help

NOTE: By moving the mouse over the buttons, the help box at the bottom of that screen will give you a brief description of the function of that button.

Disclaimer

Warning - It is the responsibility of the employer to check all monetary results of this software.

Bizz Wizz Software has endeavoured to make this software as accurate as possible. As payroll has many variations that may not have all been for seen at the time of the program's creation, Bizz Wizz Software does not take any responsibility or liability in any way for results of monies paid using this software. All results of financial or other need to checked by the program user to ensure the integrity of all output from this software. Taxation and work place agreement changes etc. may invalidate the output of this software and it is the responsibility of the program user to be aware of this.

Did you get it wrong !

Steps to change a Wage Payment

Step 1 Delete the pay or pays required from Wages Paid list

Step 2 (NOTE : Dates in the employees record in [Payment Settings] will need to be set back( 7 or 14) days before the pay date being changed,

Step 3 Go to Main

menu of wages and select button number 2 (View and Commit Current pay run)

Start a new pay run for the date of the pay run being fixed and click OK,

also days

since last pay and worked days (lower right) are important to be correct,

not in red)

Step 4 Tag the

employee for the pay run after setting the hours this pay

Step 5

Press the Pay Tagged button and click on Commit &

No Pay button and click to print or not and then click on NO to change last

pay date

Important : Then go to the employees

record and reset the date again.

Step 6 (NOTE : Dates in the employees record in [Payment Settings] will need to be set back to before the dates were changed in step 2,

Step 7 This completes the change in wages. You now need to adjust any transactions in Creditors or Ledger if amounts have changed.

--------------------------

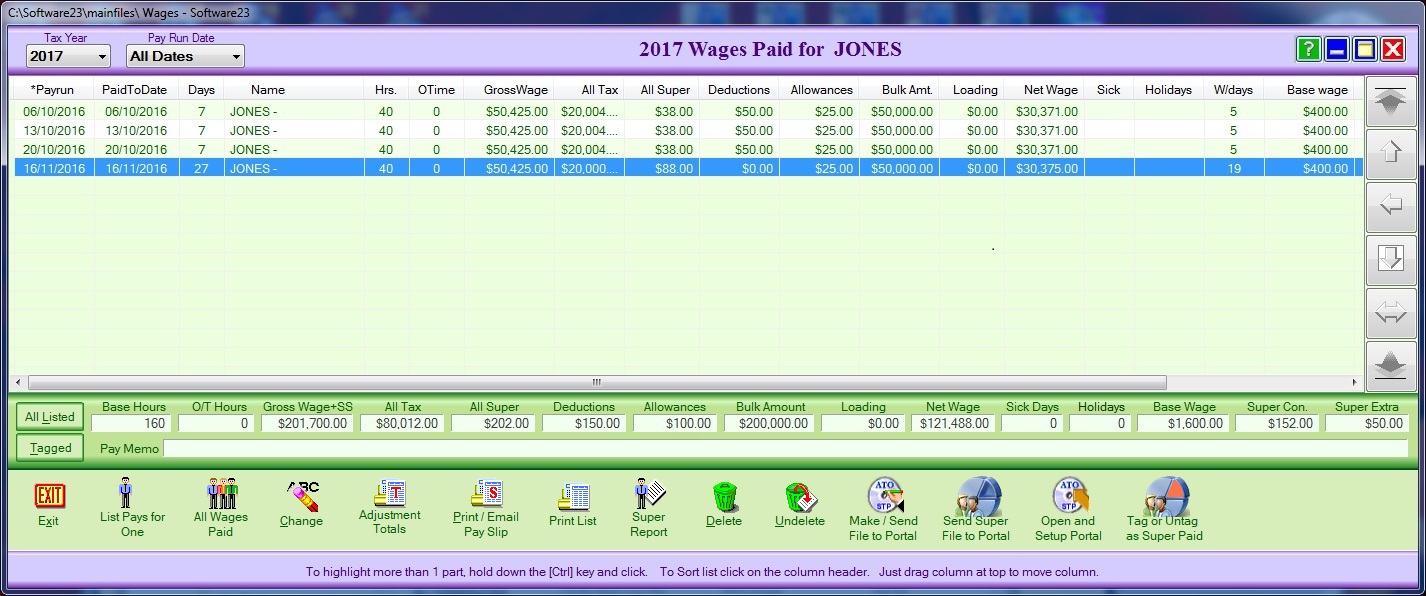

List Done Pay Runs Screen

Note if Buttons are Greyed Out the option may only be available in List Pays For One Mode.

Pay Run Date

Tagged This button is used when transactions have been highlighted to calculate the total amount of the listed transactions

All Listed This lists all transactions on the screen

Exit Button Clicking this button will take you to the main menu of Wages

List Pays for One button When this button is clicked it takes you to the Employee list. Highlight the employ and click on the select button. This will then list all the wages paid for that employee. Note - the tax year and the pay run date drop down boxes will still apply.

All Wages Paid button Clicking this button will bring up a list of all wages paid for all employees Note - the tax year and the pay run date drop down boxes will still apply.

Change button Clicking on this button will bring up a " how to " dialogue box to change a wage payment.

Adjustment Totals Button This button will be greyed out when you have more than one employee listed. If you right click on one transaction you can still get the adjustment totals for that transaction.

Print Pay Slip Button When this button is clicked a Print Menu dialogue box will show giving you options to print, email, view e.t.c.

Print List Button Clicking on this button will bring up a dialogue box asking if you want to print selected items or all items. Once an option has been selected a Print Menu dialogue box will then give you options to choose from

Super Report Button Clicking on this button will bring up a dialogue box asking if you want to print selected items or all items. Once an option has been selected a Print Menu dialogue box will then give you options to choose from

Delete Button When this button is clicked a dialogue box will ask you if you want to delete a wage for your employee. If you select OK payment transactions will need to be corrected or deleted in Creditors or Ledger

Undelete Button If you click on this button straight after you have deleted the wage payment for an employee it will bring back the transaction

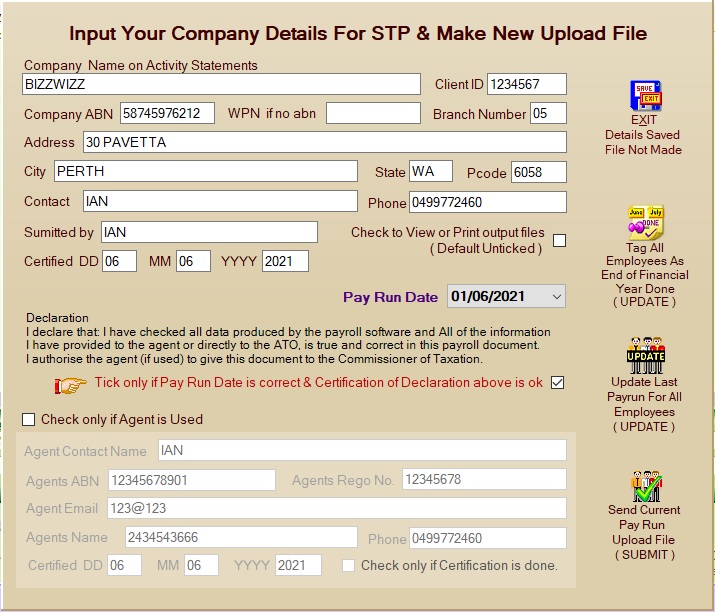

Make file Button for STP Wages Tax.

First thing to do is Tick the RED Option Tick box When read.

The Buttons on the right of the window will activate.

Starting from the bottom of the buttons on the STP make file form:

Send Current Pay Run : is the button that you use to make the payrun

file to upload to the tax portal.

This is the button you press each week to do the payrun. Note: in tkewhe portal set

the [ Message Type] to [ Submit Version 4]

Update last Payrun for all employees : This button is use to send an

update of all wages for the year, even the unemployed ones, if they have had a

wage this year.

Year to date totals are sent to update wages if you made an mistake.

Note: in the portal set the [ Message Type] to [ Update Version 4]

Update Tag all Employees as EOFY Done : This button is only used when

the Pay year is fully done so the tax office knows you are going to start a new

year next payrun.

Do this option after you have done the last weekly pay upload. Note:

in the portal set the [ Message Type] to [ Update Version 4]

Upload File Button : This will open up the web Portal. A Web page with

4 buttons will open up, Please use the help buttons on this web page

Start PORTAL =

https://www.bizzwizz.com.au/ozedi.html

HELP =

https://www.bizzwizz.com.au/helpozediact.htm#PORTAL%20HELP

If you have already done step 1 and 2 then you only need to press step 3 each

week.

---------------------------------------------------------------------------- ---

See Also : Wages Menu , Tax Totals , Setups , Employee List , Pay Run , Input Employees & Adjustments , List Pay Runs