Bizz Wizz : Setup , Main Menu , Ledger , Phone Book , Invoice Book , Stock Book , Order Book , Creditors , Point of Sale , Business Name , Diary , Wages , Document Manager , Unlock , Backup

See Also : Ledger Terms , Ledger Menu , Category List , Add / Change Record , Transaction Lists , End of Year Procedure , Bank Reconciliation , Import bank

NOTE: By moving the mouse over the buttons, the help box at the bottom of that screen will give you a brief description of the function of that button.

|

How to set up Ledger. (Down loads from web) |

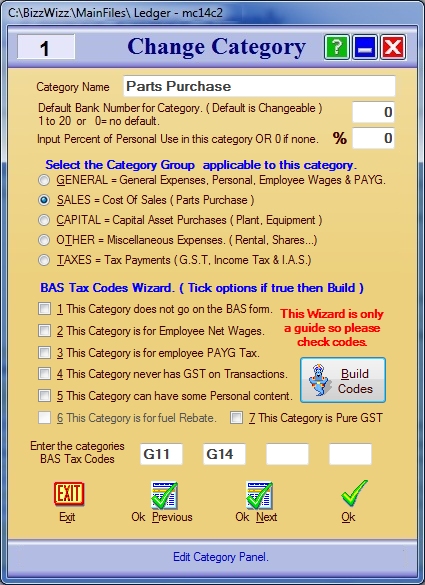

Category creation is done through the SET UP LEDGER tab on the main menu of ledger. When you are on this screen click on Change Categories & BAS Codes button which will take you to the screen below

Please note that the picture below is the same format for:

Select Category

when selecting a category just highlight the category in some cases you can pick

more than one category.

Button on this form may let you select other combinations .

Use the Tabs at the top of the list to Select Income or Expenses

Press Select Ok to go to next window

Change Category

Selecting Category:

The Category list can be Income or Expenses by clicking on the Tabs at the

top of the list. The button's on the right can also Select in some modes.

NOTE: You can also highlight more than one category to get listing in find modes. (Hold

down the [Ctrl] key and click other categories with mouse)

Add and Editing Categories:

If you need to edit any Expense or

Income category, highlight the category name, click on [Edit Category] to open the [Change Category] page

to make the changes.

If you are making a new category choose a blank line then click on [Edit

Category] which will open the [Change Category] page. Enter the new name in the

Category Name field

Default Bank Number- you can set the default bank number for this category,

setting the default number does not mean it is locked in, as it can be

changed at any input. Set to 0 if the bank number for this category is changing

all the time.

If part of this category is for personal use you need to work out what

percentage is personal. You need to enter this amount in the box next to

[Input Percent of Personal Use in this category OR 0 if none].

Next there are 5 Category group options to choose from: General, Sales, Capital,

Other and Taxes. Each category has a brief description to help you choose which

Category Group is most suitable for the category name.

Then enter the BAS Tax Code for that category.

Change Category including Wizard:

If you need help to

enter the categories BAS Tax Codes. The wizard will help you to enter the

categories BAS Tax Codes. There are Seven options in the BAS wizard. Tick these options

if they are TRUE, and then click on the [Build Codes] button. The Wizard

will automatically enter the most suitable BAS Tax Codes into the tax fields.

You should then click OK to save the data you have entered. You also have two

buttons that show [OK Previous] and

[OK Next]. This will let you move between the other categories to make any changes needed.

Guide to setting bas codes

****** PLEASE NOTE ******

VERSION 16 must have GROUP and BAS CODES entered.

HOW TO SETUP CATEGORIES IN BIZZ WIZZ LEDGER

|

Category Change Window |

Transaction Entry |

|||

|

CATEGORY |

GROUP CODE |

B.A.S. CODES |

AMOUNT ENTERED |

|

Expenses CAPAL = Capital GENAL= General Amount Tax Personal

|

Parts Purchase |

SALES |

G11 |

G14 |

|

F |

T |

|

|

|

Accountant |

GENAL |

G11 |

G14 |

|

F |

T |

|

|

|

Plant & Equipment |

CAPITAL |

G10 |

G14 |

|

F |

T |

|

|

|

BAS Payments |

TAXES |

|

|

|

F |

|

|

|

|

Phone Expenses |

GENAL |

G11 |

G15 |

|

F |

T |

P |

|

|

Petrol Expenses |

GENAL |

G11 |

G15 |

|

F |

T |

P |

|

|

Bank Charges |

GENAL |

G11 |

G13 |

|

F |

|

|

|

|

Wages |

SALES or GENAL |

W1 |

|

|

N |

|

|

|

|

Wages Tax |

SALES or GENAL |

W1 |

W2 |

|

F |

|

|

|

|

Car Rego |

GENAL |

G11 |

G14 |

G15 |

F |

TC |

P |

|

|

Rent |

MISCS |

G11 |

G14 |

|

F |

T |

|

|

|

Loan Repayment |

CAPAL |

G10 |

G13 |

|

F |

|

|

|

|

Loan Interest |

GENAL |

G11 |

G13 |

|

F |

|

|

|

|

Personal Drawings |

MISCS |

|

|

|

F |

|

F |

|

|

Super fund employees |

GENAL |

G11 |

G13 |

|

F |

|

P |

|

|

Rates / No GST Fees |

GENAL or MISCS |

G11 |

G13 |

G15 |

F |

TC |

P |

|

|

Pure GST Sales |

SALES or GENAL |

G18 |

GST |

|

T |

T |

|

Income

Amount

Tax Personal

|

Invoices |

SALES |

G1 |

G3 |

T1 |

F |

T |

|

|

|

Bank Interest |

GENAL |

G1 |

G3 |

T1 |

F |

|

|

|

|

Equipment Sales |

CAPAL |

G1 |

G3 |

T1 |

F |

TP |

|

|

|

Personal Injection |

CAPAL |

|

|

|

F |

|

F |

|

|

Tax Refund |

TAXES |

|

|

|

F |

|

P |

|

|

Fuel Rebate |

GENAL |

7D |

|

T1 |

F |

|

|

NOTE THIS CHART IS ONLY A GUIDE

F = Full Amount

IF YOU NEED MORE

INFORMATION

N = Net Amount

RING BIZZ WIZZ ON 93591921

T = GSTax in Full

TC = GSTax Claimable

Including GST on any Personal

TP = GSTax Payable

P = Personal if Applicable

See Also : Ledger Terms , Ledger Menu , Category List , Add / Change Record , Transaction Lists , End of Year Procedure , Bank Reconciliation