BIZZ WIZZ WAGES PAYROLL

Wages Menu , Tax Totals , Setups

Bizz Wizz : Setup , Main Menu , Ledger , Phone Book , Invoice Book , Stock Book , Order Book , Creditors , Point of Sale , Business Name , Diary , Document Manager , Wages Payroll , Unlock , Backup

See Also : Wages Menu , Tax Totals , Setups , Employee List , Pay Run , Input Employees & Adjustments , List Pay Runs , Super Help

NOTE: By moving the mouse over the buttons, the help box at the bottom of that screen will give you a brief description of the function of that button.

Disclaimer

Warning - It is the responsibility of the employer to check all monetary results of this software.

Bizz Wizz Software has endeavoured to make this software as accurate as possible. As payroll has many variations that may not have all been for seen at the time of the program's creation, Bizz Wizz Software does not take any responsibility or liability in any way for results of monies paid using this software. All results of financial or other need to checked by the program user to ensure the integrity of all output from this software. Taxation and work place agreement changes etc. may invalidate the output of this software and it is the responsibility of the program user to be aware of this.

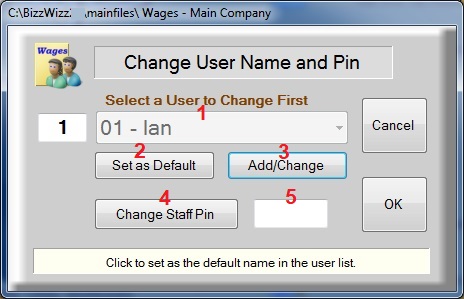

PASS WORD PIN SETUP

You may be asked for 1 or 2 Pin numbers. 1 is wager program

pin if setup and the Next is the User Pin which will always be asked for

(it was an ATO requirement )

If you have not setup your user pin number the box above will show. To

setup first select 1

your user number, then if your name is not logged to the user

number click on the [ Add/Change ] button and add your name and email.

Next click on [Change Staff Pin] and enter a Pin you would like to use.

Then enter the pin to get the main menu!

MAIN

SCREEN

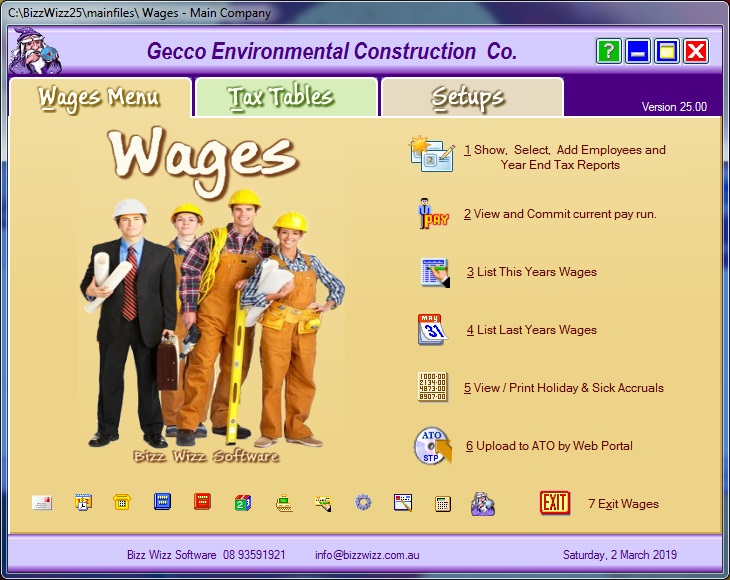

WAGES MENU TAB

Show, Select and Add Employees button Clicking on this button will bring up your employee list. For more information go to employee list.

View and Commit current pay run button Click on this button to either view or commit current pay run for selected employees.

List This Years Wages button This

button brings up a list of wages paid for all employees in the current

financial year.

List Last Years Wages button Clicking this button will bring up a list of wages paid for employees for previous financial years

View / Print

Upload to ATO By Web Portal

Clicking on this button will load a web page with 3 Steps.

Step 1 is to set up a new account.

Step 2 is to fill in details and Buy Down Data.

Step 3 is to download your weeks Payrun file to the ATO.

Exit Wages button Click on

this button to exit the Wages module.

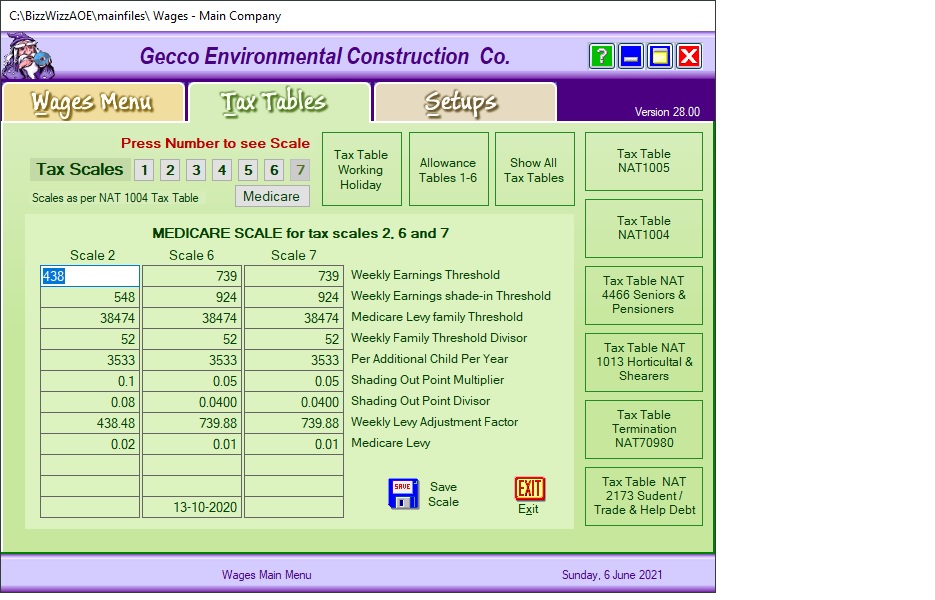

There are seven Tax Scales. These are selected when information is

entered for the employee record. The Medicare scale is generally used for

Tax Scales 2, 6 and 7.

You can change the tax tables manually using the table in the NAT-1004 from the

tax office

Tax Table NAT 1004 button Clicking on this button brings up the Statement of Formulas for Calculating tax amounts to be withheld from the ATO website. The current tables from within this document are used to calculate employee with holding tax. There is also a table allowing you to check the tax this program produces

Tax Information buttons These Buttons are to help you find other wage information from the ATO website.

Tax Table NAT 2173 button When this button is clicked the Higher Education Loan weekly tax deductions can be calculated. This table is from the ATO website.

Exit button Click this button to exit out of the Tax Table screen.

Save Scale button Clicking this button will save the Tax Scale if you have changed it.

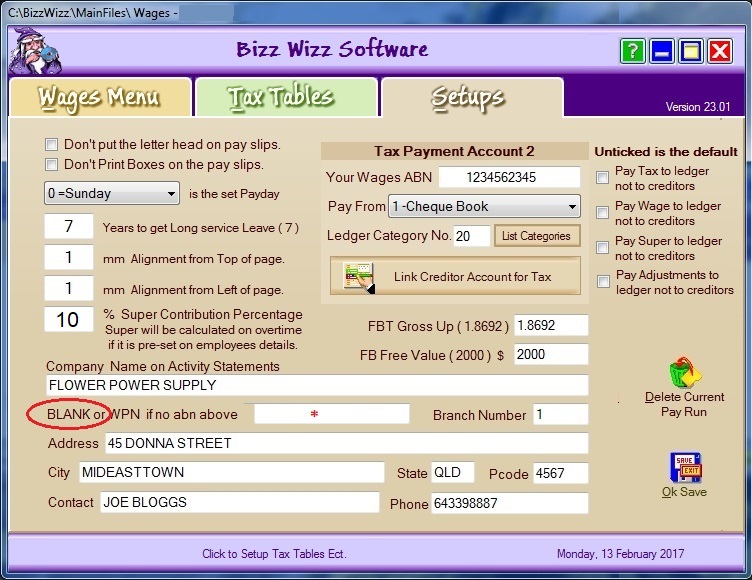

Don't print boxes on the pay slips tick box If this box is not ticked, boxes will be printed on the pay slip printout.

The set pay day Select the day the pay day run is done on.

mm Alignment from Top of page The alignment number for this varies depending on the printer. Set the number that is relevant to your printer to align print to the top of the page.

mm Alignment from the Left of page The alignment number for this varies depending on the printer. Set the number that is relevant to your printer to align print to the left of the page.

Super Contribution Percentage Enter the number 9.5 in the percentage box if your super contribution percentage is 9.5 percent. Please check current rate and set right percentage.

The information must be entered

Company Name on Activity Statements Enter your company/business name in this box that is normally used for the Taxation Office.

BLANK or WPN for paying wages Enter your WPN (Wage Payer Number) number for wage payments. NOTE leave Blank if an abn has been entered in (your Wages ABN)

Address Enter the Business address in this box.

City Enter the city or name of suburb.

State Enter the state initials.

Postcode Enter the postcode number.

Contact Enter the name of the contact person.

Phone Enter the phone number of the business.

Tax Payment Presets determines where the tax payments will be paid to in Creditors and the bank it is paid from e.t.c.

Your Wages ABN Type in the business Tax File ABN Number. ( MUST BE FILLED IN )

Pay From Select the bank number from which the payments are being made from.

Ledger Category No: Select the category number listed in the Ledger Category list.

List Categories Clicking on this button will bring up the existing list in the Ledger. (adding to the category list must be done in the Ledger program)

Link Creditor Account for Tax When this button is clicked it will bring up your suppliers list. If the category is not already there you can add a new one by clicking on the Add New button

FBT Gross Up ( 1.8692 ) This percentage is set at 1.8692 but can be changed if the Taxation Office changes the percentage. You must check this value every year with the ATO

FB Free Value ( 2000 ) The dollar value of $2000 or less ( this amount can be changed ) is the non reportable amount. If the FBT amount is less than this figure it does not need to be put on the employees payment summary.

Delete Current Pay Run button Clicking on this button will bring up a dialogue box. If you wish to continue deleting the file press yes. If you click no, it will cancel out. This will not delete pay runs already committed.

OK Save Click this button to save the information entered on this screen. You will then be back at the main menu of Wages.

See Also : Wages Menu , Tax Totals , Setups , Employee List , Pay Run , Input Employees & Adjustments , List Pay Runs